What Does Aggregate Mean In Insurance Deductible

Aggregate — (1) a limit in an insurance policy stipulating the most it will pay for all covered losses sustained during a specified period of time, usually a year.aggregate limits are commonly included in liability policies. These plans do not have the separate ( embedded) individual deductible per person like conventional ppo plans.

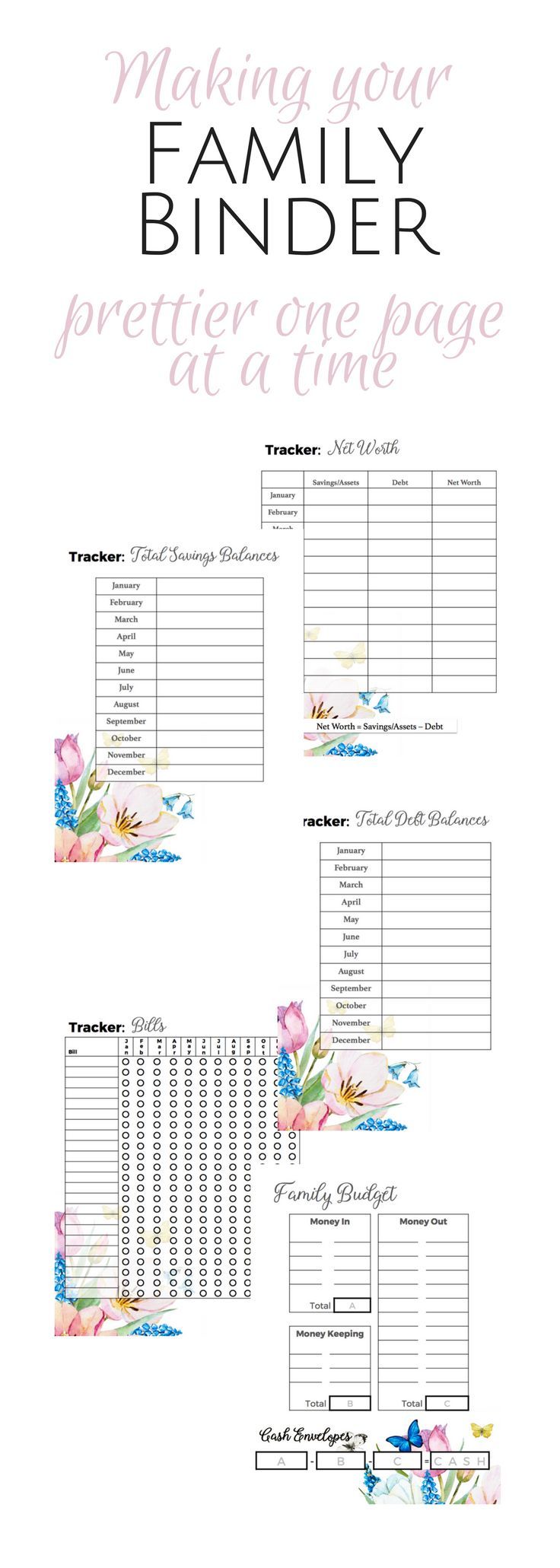

If you are following Dave Ramsey's Baby Steps, this

Hereof, what does policy aggregate mean?

What does aggregate mean in insurance deductible. This means that the deductible for all persons covered on the plan must be met before any other benefit is paid by the insurance. The aggregate deductible is the maximum deductible amount your firm will pay in a policy period on multiple claims. Sometimes called annual aggregate deductible.

Health insurance plans often carry aggregate limits. An aggregate deductible is the limit deductible a policyholder would be required to pay on claims during a given period of time. Let's start with in the aggregate.

If the total amount of paid claims exceeds the set plan amount, the insurance carrier must reimburse the employer for any overage charges. If it's under the aggregate maximum family amount, a coinsurance percentage might be applicable. An aggregate annual deductible is the maximum amount policyholders need to pay within a policy period before their insurer pays for covered losses.

Anthem select, choice, care, & the epo all have an embedded deductible & out of pocket maximum. What does aggregate deductible mean in insurance? An aggregate limit is a maximum amount an insurer will reimburse a policyholder for all covered losses during a set time period, usually one year.

Offers protection to the insured from a high frequency of losses; What aggregate stop loss coverage does is protect the employer against higher than anticipated claims. For example, if your level of cover is £250,000, your insurer will never pay out more than that, in total, for all claims and their associated legal costs in a year.

In most cases these high deductible plans have an aggregate deductible. I rarely see it used in individual major medical plans except for those plan designs that are hsa qualified. In other words, if a policyholder files several claims or one large claim, they must pay out of pocket up to a certain dollar sum.

A type of deductible that applies for an entire year in which the insured absorbs all losses until the deductible level is reached, at which point the insurer pays for all loses over the specified. When you reach an aggregate deductible for the family, the insurance company pays the total allowable portion of the next person's claim. Aggregate deductible — the maximum amount the insured can pay as deductibles over a specified period, typically 1 year.

Aggregate deductibles are most likely to be features of product liability policies, or policies that might result in a large number of claims during a certain time period. An aggregate annual deductible is the maximum amount policyholders need to pay within a policy period before their insurer pays for covered losses. In other words, if a policyholder files several claims or one large claim, they must pay out of pocket up to a certain dollar sum.

Per location aggregates on liability insurance policies. With aggregate stop loss, the employer is still responsible for claims expenses under the deductible amount. An aggregate limit is a cap on the maximum amount an insurer will pay in claims to a policyholder over a set period, usually one year.

Aggregate means all or total. Subsequently, coverage kicks in, and the insurer starts making payments. Insurance deductible pertains to the amount of money on an insurance claim that you would pay before the coverage kicks in and the insurer financial intermediary a financial intermediary refers to an institution that acts as a middleman between two parties in order to facilitate a financial transaction.

The stop loss provides you with financial protection against extreme severity—without it, you’d be responsible for paying the full deductible on an unlimited number of claims. This type of cover places a 'ceiling' on how much your insurer pays out. The aggregate stop loss limit is the total amount your business is responsible for over the course of the entire period.

(hdhp) has an aggregate deductible but an embedded out of pocket maximum. What does per location aggregate mean? The term is used often in self funded employer group plans where the employer is funding the claims up to an aggregate cap (if they have purchased medical stop loss coverage).

An aggregate deductible is the limit deductible a policyholder would be required to pay on claims during a given period of time. Offers protection to the insured from a high frequency of losses; What does aggregate annual deductible mean?

What does aggregate limit mean in insurance? Insurance policies typically set caps on both individual claims and the aggregate of claims.

If you have both primary and secondary health insurance do

Understand Who's at Fault in a Car Accident Allstate

Simple Guidance For You In Medical Insurance Tax

Do I need insurance for my home business? Dave ramsey