Decreasing Term Insurance Premiums

Term insurance is a type of life insurance plan that provides a life cover for a fixed ‘term’ of the policy at affordable premiums. Ideally, the size of the policy also decreases over the period, until the coverage period concludes or until the policy pays out.

Art and antiques buying continues to heat up! What’s

For example, if your kids are heading into college and beyond, you may.

Decreasing term insurance premiums. Among the shortlisted life insurers, axa offers the most customisation options for its term insurance plan. As the name implies, decreasing term coverage is a type of life insurance where the actual death benefit will drop over time. The death benefit decreases as the amount of money you owe on the mortgage decreases.

It is just opposite to the decreasing term insurance plan. Decreasing term insurance is a life insurance product that provides decreasing coverage over the term of the policy. Decreasing term life insurance is best for you when:

People who opt for decreasing term life insurance policies usually do it to cover a mortgage or other financial obligation. Decreasing term life insurance is especially useful when the amount of money needed at death diminishes over time. As the name suggests, an increasing term insurance plan is a term insurance plan wherein the sum assured chosen on plan commencement increases every year by a specified amount.

‘term’ means it has a fixed number of years to run and eventually expires. In decreasing term insurance, the amount of coverage decreases year after year in exchange for a fixed and low premium rate. Decreasing term life insurance is commonly used specifically for one of the following debts:

Premiums are usually constant throughout the contract, and. Decreasing term is ideal for insuring a liability that is gradually being paid off, like a home mortgage. As the years go by, your policy will be worth less and less, even though your premiums will stay the same.

Decreasing term life insurance is a type of life insurance policy that pays out less over time. There’s actually a fair bit of science that goes into decreasing the car insurance premiums for every single member of the royal kingdom. Life insurance companies will use age as a determinant for life insurance premiums.

So, here is a simple illustration. If you only want life insurance to cover a. Level term life insurance may be a better option, as it provides.

You can choose to be covered for a certain number of years (5, 10, 15, 20, 25, or 30 years) or to a certain age (choices are age. Decreasing term life insurance is a type of insurance where the premiums stay the same, but the death benefit decreases over time. ‘assurance’ shows that it is an insurance product.

Decreasing term insurance refers to a type of annual renewable term life insurance policy with a decreasing death benefit (face amount) and level premiums. A decreasing term policy usually lasts for five to 30 years and pays out if you pass away during that time. It’s often used to cover the balance of a repayment mortgage, because the total balance of the mortgage decreases over time and will be paid off in full at the end of the term.

Decreasing term life insurance is a type of term life insurance that offers a death benefit that shrinks over the duration of the policy (typically five to 30 years). Though a decreasing term insurance plan is a simple type of term plan, you might get confused on how the plan works. Decreasing life term insurance is not at first easy to understand, but it should become apparent with some basic explanations.

Premiums of decreasing term insurance plans are, usually, lower than premiums of a normal term insurance plan where the sum assured remains the same. What is decreasing term insurance? How does decreasing term life insurance work?

The benefit under the plan known as the death benefit is provided to the nominee in case of an unfortunate demise of the life assured. Premiums stay level, but the death benefit decreases over time. Example of decreasing term life insurance.

Decreasing term life insurance is tied to a debt, like a mortgage or loan. You pay the same amount each month or year, but your death benefit grows smaller. Some good reasons to get a decreasing term policy include:

These are also known as protection plans. A decreasing term life insurance policy is typically cheaper than a level term policy because the death benefit your beneficiaries would receive is reduced over time. Policies are usually tied to a large loan—the benefit decreases as you pay off what you owe.

The term length is equal to the timeframe of your loan. It’s a bit beyond us mere mortals, but suffice it to say that there are some super intelligent math wizards who use the average rate of depreciation of a car to determine what you should be paying to insure said car. Situations decreasing term life insurance can help.

Rates will continue to increase as you age due to a decrease in your total life expectancy. Decreasing term insurance doesn’t offer adequate coverage for your family. Decreasing term insurance, also called dta insurance, can be defined as a life insurance policy with a feature that allows for the decrease of the benefit on a monthly or yearly basis.

Decreasing term insurance is renewable term life insurance with coverage decreasing over the life of the policy at a predetermined rate. How decreasing term insurance plans work? An insurance policy that decreases.

The payout amount shrinks over the life of the policy, but your policy premium stays the same. When you first purchase any life insurance policy, you will choose a term length and a death benefit (or policy value). You anticipate your need for life insurance will diminish in your later years.

Life is full of unexpected events some of them good

Save on Insurance Premiums (13 Actionable Strategies

An alternative is the "Decreasing Term Life Insurance

An option is the "Decreasing Term Life Insurance coverage

3 easy steps to register for National Pension Scheme Nps

An alternative is the "Decreasing Term Life Insurance

Private Mortgage Insurance What Property Buyers Need to

Affordable Life Insurance For Smokers Under 40 To 60 in

What Does The Ultimate Safe Driver Look Like? Infographic

An option is the "Decreasing Term Life Insurance coverage

Start Health insurance cost, Pay off mortgage early

An alternative is the "Decreasing Term Life Insurance

Pin on Life insurance marketing

An alternative is the "Decreasing Term Life Insurance

Pin von Zurich Insurance auf Protection Gaps

What is term life insurance?, Term life insurance, Level

15 Essential Home Budget Hacks to Save You 1000s (With

Save/Reduce Tax Burden and Create Wealth! Portfolio

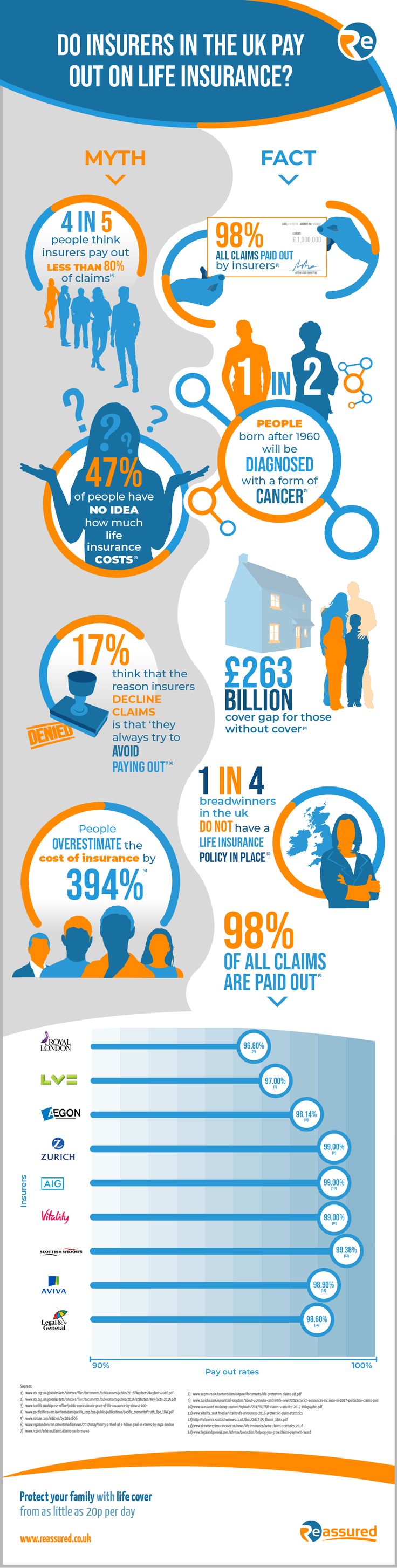

Recent research from a range of sources, including